nd tax commissioner payment

If the second payment is not paid on or before October 15th penalty is 6 to January 1st. This position processes work items related to employer income tax withholding and royalty withholding within the section.

Ndtax Department Ndtaxdepartment Twitter

North Dakota property tax is determined by multiplying the taxable value of real property -- land and buildings -- by the local mill rate.

. Tax receipts filed with county auditor - Copies retained. One North Dakota Login and password to access multiple ND Online Services. Simple interest at 12 annum will begin after January 1st.

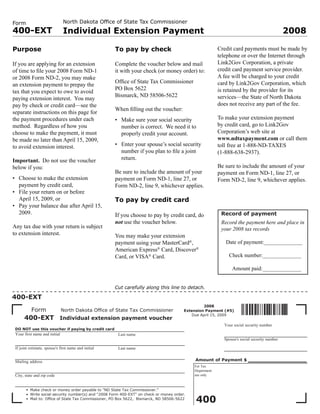

Office of State Tax Commissioner PO Box 5622 Bismarck ND 58506-5622 2022 Make payable to. Benefits of North Dakota Login. Tasks associated with this position include assisting employers.

TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view. North Dakota Taxpayer Access Point ND TAP is an online system taxpayers can use to submit electronic returns and payments to the Office of State Tax. Office of State Tax Commissioner PO Box 5622 Bismarck ND 58506-5622 2022 Make payable to.

You will need to have your property address statement number or parcel. Proof of payment for deliveryinstallation. Its simple secure and easy to implement.

Register once for secure. Welcome to the North Dakota Property Tax Information Portal. Manage your North Dakota business tax accounts with Taxpayer Access point TAP.

Office of State Tax Commissioner 600 E. Questions about paying your taxes online please contact. Office of State Tax Commissioner PO Box 5622 Bismarck ND 58506-5622.

County parcel tax information can be accessed by clicking on the County of your choosing using the interactive map above. A tax lien will be put on. Pay Property Tax On-Line.

The tax commissioner shall annually calculate the amount of credit to which a company is entitled under this section. City State ZIP Code Payment Amount Mail payment and voucher to. To make an on-line tax payment click on the Research or Pay Property Taxes button below.

Unemployment Insurance Tax. Payment Amount Due 15th day of 4th month following end of tax year Mail payment and voucher to. This position processes work items related to employer income tax withholding and royalty withholding within the section.

Tasks associated with this position include.

/cloudfront-us-east-1.images.arcpublishing.com/gray/A6GMNR3KZRISHPLZOIZYZQS7AU.jpg)

Nd Tax Commissioner Talks About How The Gop Tax Bill Benefits Those In Nd

Energy Policy Special Nd Tax Commissioner Candidate The Crude Life

400 Ext Enabled Nd Gov Tax Indincome Forms 2008

Fillable Online Nd North Dakota Office Of State Tax Commissioner One Time Remittance Form Please Check Appropriate Return See Page 2 For Instructions For Office Use Only Voluntary Sales And Use Tax

Ndtax Department Ndtaxdepartment Twitter

North Dakota Tax Commissioner Letter Sample 1

Welcome To The North Dakota Office Of State Tax Commissioner

Ndtax Department Ndtaxdepartment Twitter

North Dakota Office Of State Tax Commissioner Bismarck Nd Facebook

Ndtax Department Ndtaxdepartment Twitter

Ndtax Department Ndtaxdepartment Twitter

Local Attorney Nominated For Vacancy On Missouri Court Of Appeals Southern District West Plains Daily Quill

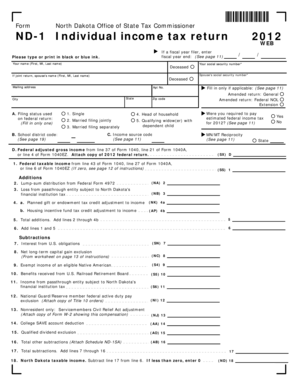

Fillable Online Nd Form North Dakota Office Of State Tax Commissioner Nd 1 Individual Income Tax Return Please Type Or Print In Black Or Blue Ink Fax Email Print Pdffiller

North Dakota Taxpayer Access Point

North Dakota St Sales Use And Gross Receipts Form Fill Out Sign Online Dochub

Democratic Challenger For N D Tax Commissioner Floats Tax Breaks For Military Grand Forks Herald Grand Forks East Grand Forks News Weather Sports

North Dakota Governor Looking For Tax Commissioner Appointee Govt And Politics Bismarcktribune Com